Allocations, Tech, Talent: Deloitte’s 2019 Commercial Real Estate Report

by Janover Team

Last updated on October 1, 2024

Deloitte Center for Financial Services publishes a yearly report covering an outlook on the near-term future of commercial real estate based on surveying hundreds of CRE investment professionals. Since the prospect of predicting the near-future in CRE is virtually irresistible to CRE investment professionals, we figured we’d review the 2019 report very closely to give you a summary of the main takeaways.

tl;dr

In an attempt to help CRE firms understand an evolving environment, Deloitte’s survey revealed that RE investment companies are being challenged to effectively navigate and adapt to an accelerating pace of change. Traditional playbooks wont work fast enough to keep firms agile and evolving to remain successful in the future. LPs in the United States and Canada are interested in increasing their capital commitments to CRE. Many of them expect to prioritize investing with GPs who react quickly to trends in business models and adopt technology that make investments future-ready. This amounts to great news for the deal sponsors willing to look into the future to envision today’s offerings. Conversely, terrible news for the GPs either not willing, or afraid, to play ball and evolve with the market.

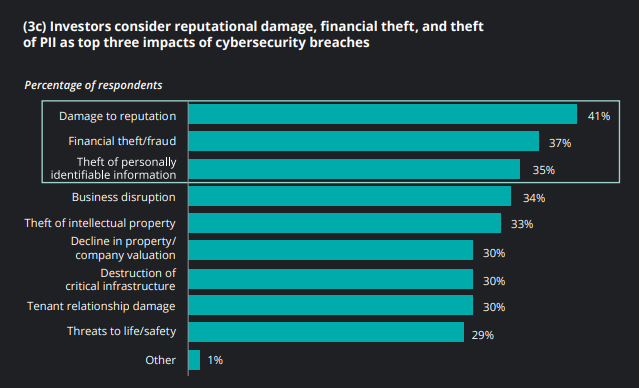

Naturally, all of this excitement about a tech evolution in CRE has a flipside as concerns over cyber security intensify. Reputation damage and theft of PII (Personally Identifiable Information) ranked as top concerns LPs have when it comes to data security. The report highlights the burgeoning preference proptechs are enjoying among investors. CRE companies need to be proactive about adopting proptech solutions to stay competitive in keeping and gaining their share of investment dollars.

Finally, investors are concerned that CRE firms are under-equipped to recruit and integrate talent from the millenial and Gen-Z generations. The report ends with this bit of advice: “Be agile. Fail fast. Adapt rapidly.” Sure, this may cause anxiety to some traditional CRE firms, but it’s not the advice CRE firms need, it’s the advice CRE firms deserve ?.

Why continue reading:

Well, I might make another Batman reference. If that’s not enough, we’ll see more details and stats from the survey that contextualize the challenges mentioned above. We’ll also share suggestions from Deloitte’s report and our team for GPs who want to stay ahead of the curve and attract the growing allocations to CRE.

A changing world with more capital being allocated to CRE.

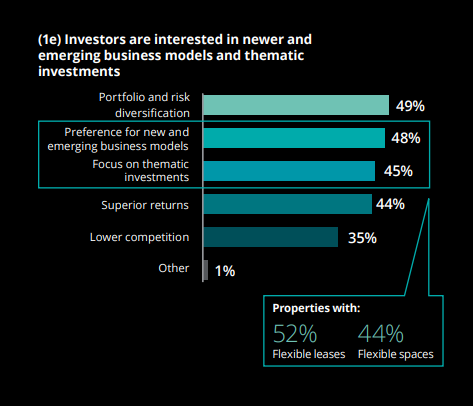

Worldwide, 97% of the survey respondents intend on increasing their capital commitment to CRE over the next 18 months. Within that same timeline, those in the USA plan on increasing their commitments by 13%. Surveyed Investors plan on diversifying their portfolio, they seem to understand the need to tie their investment strategies to the evolving state of work and tenant preferences. While diversification reigns supreme with 49% of respondents’ interest, emerging business models such as flexible leases and flexible spaces followed very closely behind at 48%. Forty-five percent of investors surveyed are also interested in thematic investment strategies. Following this logic, we can expect firms with focused funds to attract more investment dollars going forward. Look out for growth in allocation towards data-center, senior-housing, sustainability or other trending themes. Impressive enough, “superior returns” came in fourth place (albeit very close) with 44% of respondents expressing interest. These results seem to highlight a fascinating mix of a pragmatic and innovation-seeking sentiment among CRE investors. It leads to the interesting conclusion that at this crossroads, diversification and new business models might be one and the same.

CRE firms should consider rebalancing their investment strategies going forward, if they haven’t already. CRE firms should strive to offer deals that continue to fit their internal standards of quality while appealing to the external force; LP interests. By placing disproportionate efforts into deals that fit this suggested criteria in the coming years and communicating these complex ideas clearly to investors, investment firms will rebalance their portfolio and gain a competitive advantage in attracting more LP mindshare.

Janover Connect Plug: Janover Connect’s CRE syndication tools allow you to publish new offerings and clearly communicate with your LPs with a few clicks and within a few minutes.

RE investing is being popularized as a meaningful long-term play for many newcomers. As investors, private and institutional, are planning on increasing their allocations to CRE, CRE investment firms are experiencing an opportunistic time to get in front of them and diversify their investor base. This marks a specially bright opportunity for smaller REITs to gain exposure to large institutional investors, as institutions expand beyond their core in search of higher yields.

Learn more about how CRE companies can adapt to and take advantage of this changing environment in Deloitte’s report at pages 5-7.

Technology for better decision making, and smarter buildings

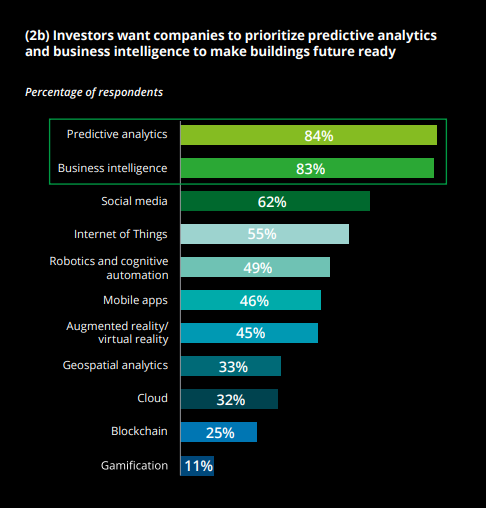

Investors have remarkably strong feelings towards the use of technology, but CRE is considered to be one of the industries that is still playing catch-up in the use of technology to drive business value. In Deloitte’s survey, 84% (84!!!) think CRE firms need to integrate predictive analytics, and 83% (83!!!) believe CRE firms need to make use of business intelligence to help make investment decisions and future-proof their investments. Additionally, 55% of investors responded that CRE firms should integrate IoT (internet of things) in their building (re)development, and 26% think it should be a priority. As for timing, investors believe the tech impact is imminent. Sixty-eight percent of them expect the greatest impact of technology on legacy properties to happen within the next 18 months to 5 years.

There is no arguing with these staggering numbers. CRE has been slow to adopt new technologies, and new technologies have been slow to support CRE. No one is at fault, but investors expectations are as clear as daylight. This is great news for the firms who will take this shift in expectations as an opportunity to cater to those investors, especially at a time when the vast majority of firms’ marketing messaging remain silent on these expectations. The formula is simple, create a technology-based strategy to improve the financial performance of your properties, create a tech-based ecosystem for your firm’s decision making and investor relations, and be the CRE investment sponsor that an overwhelming portion of investors are hoping to find.

Cybersecurity continues to be a major concern.

The survey revealed growing concern regarding cybersecurity, an understandable trend considering the advent of CRE focused technology tools. Additionally, one-third of real estate firms have experienced a cyber-security threat in the past two years alone and many companies don’t feel prepared to for such threats.

Investors consider damage to reputation, financial theft, and leak of personally identifiable information as the most impactful consequences of data breaches. Business disruption and theft of IP closely follow.

The consequences of losing investor trust are fundamental, so CRE investment companies should take a proactive approach to managing cyber-risks. This can be done by evaluating their susceptibility to cyber-attacks and identifying appropriate responses. This also includes evaluating employees’ exposure to cyber-risks and instilling responsibility and accountability in them through education on threats, like phishing and malware download attempts. Finally CRE firms can make use of sensing technology to identify potential threats early.

It’s time to start finding talent in the new generations.

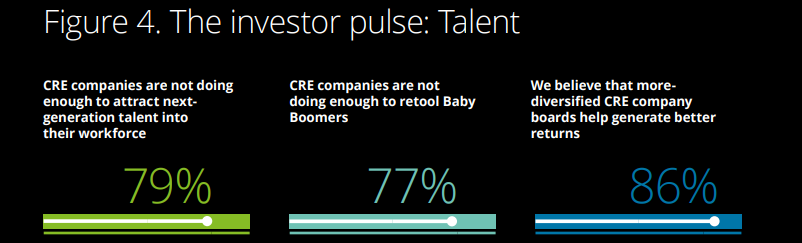

An overwhelming majority of investors agree that CRE companies need to do more to nurture their talent. The industry “seems unprepared to recruit, engage, and retain” Millennial and Gen-Z talent. Meanwhile the ability to reskill Baby Boomers is also being questioned by investors. To attract next-generation talent, companies should enrich the employee experience, use social media and branding to change market perceptions, frame their mission to give new talent a real sense of purpose and consider implementing flexible policies that enable mobility. Whether you agree with these values or not is irrelevant, those are the values the new generations are seeking and top talent is a competitive market. In addition to re-skilling Baby Boomers who wish to extend their careers instead of retiring, CRE firms could establish knowledge-transfer programs from Baby Boomers to the next generations. Investors are also shown to believe strongly in diversity and that it should reach the senior levels of CRE firms. 86% of those surveyed believe that more diversified boards help generate better returns.

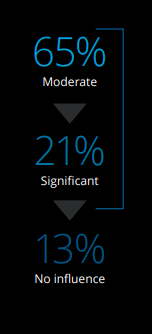

Eighty-six percent of investors agree: Protechs will have moderate to significant impact on the industry.

Finally Deloitte’s article highlights that investors overwhelmingly expect that engaging proptechs (technology and software companies focused on enabling commercial real estate firms) is indispensable to gain a competitive edge. It’s perhaps more impactful to think of this from the opposite angle; firms that do not engage and experiment with technology will lose relevance to those that do.

CRE companies must become knowledgeable on how proptechs can create value for their business and investors. CRE firms must see proptechs as collaborators and not disrupters. At this stage of technology permeation throughout the industry, CRE firms must be ready to see partnerships with proptechs as a win-win opportunity where CRE firms can match their industry knowledge to proptech’s technology knowhow and innovation driven DNA. Deloitte suggests that CRE firms figure out a protocol for engaging proptechs in a coordinated effort. Some ideas are to establish a main point of contact internally, guidelines on new tech adoption, and metrics by which to measure ROI from partnering with proptechs.

Consensus and learn more

It’s very interesting to note that, overall, the ideas and thoughts being highlighted for 2019 and the near future had very strong consensus among respondents. The report was packed with more data from the surveys and we recommend checking it out in its entirety if you’d like to dive deeper into the survey results, survey methodology and background on responding population.

Is your firm adapting and evolving? by choice or by force? Let us know how your firm is responding to shifts in the market and which changes do you see becoming more relevant in the months ahead.

Join 6,000+ syndicators in getting guides, models, presentation templates, and more resources created to help you become a better investor.

Raise Capital Faster with Janover Connect

Elevate your real estate investment and syndication processes with Janover's comprehensive platform.

- Fundraising Automation

- Investor Portal

- Distribution Management

- Reporting & Analytics

Subscribe to Our Blog

Join 2,000+ syndicators in getting guides, models, presentation templates, and more resources created to help you become a better investor.

Empower Your Real Estate Investments

Janover Connect provides powerful tools to streamline your real estate investment and syndication processes.

Janover Connect

Streamline your real estate syndication, impress your investors and close deals on autopilot.

- Fundraising Automation

- Investor Portal

- Investor Reporting

- Distribution Automation

- K-1 Sharing

- Communication Tools

Janover Engage

Raise funds faster and easier by getting your syndication deals in front of the right investors.

- 52,549+ investors network

- $1B+ confirmed investments

Ready to Transform Your Investment Process?

Discover how Janover Connect can help you impress investors, close deals, and manage your real estate empire with ease.