Rolling Funds Versus Syndication Explained

by Janover Team

Last updated on October 1, 2024

Rolling funds have been attracting a lot of attention recently in venture capital. In this article, our goal is to help you understand how rolling funds are different from syndication and traditional venture capital funds. The primary differences between a rolling fund and syndication for investors are as follows:

- Syndicates invest in one company at a time.

- Syndicates aggregate a group of investors into one special purpose vehicle that invests in the project, while rolling funds are a series of limited partnerships.

- Syndicates lowered the bar to investing, allowing for easier access to deal flow, but Rolling Funds take this concept even further.

What is Rolling Funds?

They are structured as limited partnerships (LPs), and at the end of the previous quarterly investment period, a new fund is offered. A new fund is launched each quarter and remains open to new accredited investors. Because they fall under the SEC’s Rule 506(c), fund managers can market them to the public.

Investors join the rolling fund for a minimum time commitment and then invest quarterly. Rolling Funds have lowered the cost and effort needed to create a fund by simplifying the process and making them open to raising funds continually. However, many see them as a better way to raise capital and invest money when compared to traditional fund sources.

Is there a minimum investment for a Rolling Fund?

There is no standard minimum investment, but a typical minimum quarterly subscription ranges from $6,250 per quarter to $25,000 per quarter. The fund managers determine the exact amount and establishes specific terms and investment details for their specific rolling fund.

Suppose a rolling fund doesn’t use all of its allocated capital in a quarter. In that case, the balance is then automatically rolled into the next quarterly fund as additional capital from the fund’s current subscribers.

What are some of the common fees LPs should be aware of for Rolling Funds?

Typical rolling fund fee structures can include:

- Fund managers fees (approx. 2% per year over the life of the fund, calculated and charged quarterly)

- Carry (20% - 50%)

- Preferred interest (usually 8%)

- Minimum term commitment (anywhere from a single quarter to four or more quarters)

- Fund administration fees (starting at $500 per month for each Series)

- Legal and set up fees ($10,000 one-time fee)

Distributions for rolling funds are handled similarly as with typical venture capital funds. Structured as a series of limited partnerships, subscribing LPs receive distributions (net of fees) from the quarterly funds to which they contributed capital.

Rolling Funds Versus Traditional Funds

It is also essential to understand the advantages of rolling funds over traditional funds. Some of these advantages include the following:

- The ability to raise funds continuously The best thing about it, is that they continuously raise funds, which dramatically decreases the initial amount of capital that is needed. On the other hand, traditional venture focus on one big fundraiser that usually occurs over a short period of time, after which there’s no further raising of funds.

- Rolling funds allow for more flexibility Rolling funds offer more flexibility to investors as they can increase, stop, or decrease their investments on a quarterly basis.

The Future of Rolling Funds

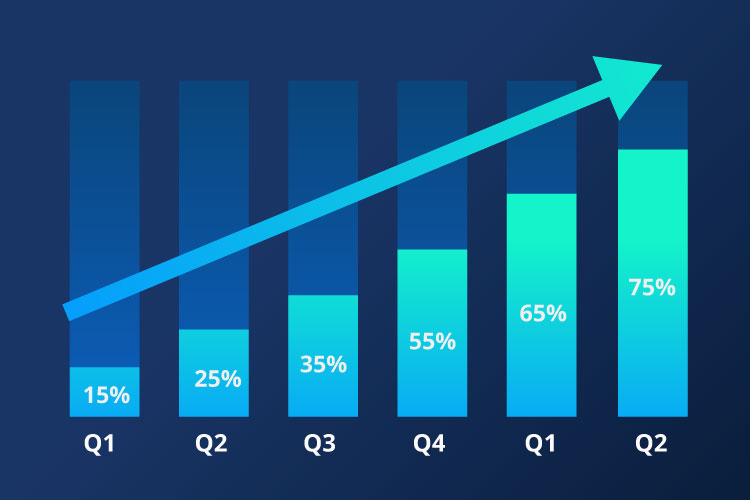

The interest in traditional venture has decreased as accredited investors have seen the flexibility and many advantages rolling funds offer. These funds represent a significant shift in the industry with their innovative approach to funding and finance. Rolling funds can help real estate syndicators raise funds for their real estate investments by using this vehicle that is much easier and accessible to investors.

We don’t see the interest slowing down any time soon, and we expect that they will continue to take over the role historically played by traditional venture. If you’re interested in learning more about the use of rolling funds as it applies to your business, schedule a demo today

Raise Capital Faster with Janover Connect

Elevate your real estate investment and syndication processes with Janover's comprehensive platform.

- Fundraising Automation

- Investor Portal

- Distribution Management

- Reporting & Analytics

Subscribe to Our Blog

Join 2,000+ syndicators in getting guides, models, presentation templates, and more resources created to help you become a better investor.

Empower Your Real Estate Investments

Janover Connect provides powerful tools to streamline your real estate investment and syndication processes.

Janover Connect

Streamline your real estate syndication, impress your investors and close deals on autopilot.

- Fundraising Automation

- Investor Portal

- Investor Reporting

- Distribution Automation

- K-1 Sharing

- Communication Tools

Janover Engage

Raise funds faster and easier by getting your syndication deals in front of the right investors.

- 52,549+ investors network

- $1B+ confirmed investments

Ready to Transform Your Investment Process?

Discover how Janover Connect can help you impress investors, close deals, and manage your real estate empire with ease.