How to Distribute K-1s to Your Real Estate Investors - Best Practices for 2024

by Janover Team

Last updated on October 1, 2024

As a real estate syndicator, distributing K-1 forms to your investors is a crucial annual task. But what’s the best way to handle this sensitive information?

This guide will walk you through the most common K-1 distribution methods, their pros and cons, and best practices to ensure security and efficiency.

Let’s start with a fundamental question:

What Are K-1 Forms and Why Are They Important?

K-1 forms are tax documents used to report each partner’s share of income, deductions, credits, etc. from a partnership investment. For real estate syndications, K-1s provide investors with the information they need to report their share of the property’s financial activity on their personal tax returns.

Distributing K-1s accurately and securely is critical for:

- Maintaining investor trust and satisfaction

- Ensuring tax compliance

- Protecting sensitive personal and financial information

Now let’s look at the main distribution methods:

4 Common Methods for Distributing K-1s

1. Physical Mail

Pros:

- Highly secure when done properly

- Familiar and expected by many investors

- No technology barriers

Cons:

- Time-consuming and labor-intensive

- Risk of lost or undelivered mail

- Delays in investor receipt

Best Practices:

- Use tracking and signature confirmation

- Double-check current mailing addresses

- Consider certified mail for added security

2. Email

Pros:

- Fast and convenient

- No printing or mailing costs

- Easy for investors to access

Cons:

- Security risks if not properly encrypted

- Potential for interception or unauthorized access

- May end up in spam folders

Best Practices:

- Use encrypted, password-protected PDFs

- Send passwords separately via a different method

- Implement secure email protocols (TLS, S/MIME)

3. Secure File Sharing Platforms

Pros:

- More secure than standard email

- Allows for access controls and expiration dates

- Easy to manage and track downloads

Cons:

- Requires investor sign-up/login

- Some investors may be unfamiliar with the platform

- Potential costs for premium features

Best Practices:

- Choose a reputable platform with strong security features

- Provide clear instructions for investor access

- Set expiration dates for document links

4. Investor Portal Software

Pros:

- Highest level of security and control

- Centralizes all investor communications and documents

- Provides additional features for investor management

Cons:

- Requires initial setup and investor onboarding

- May have higher costs compared to simpler methods

- Learning curve for you and your investors

Best Practices:

- Select a user-friendly platform with robust security

- Offer training or support for investors new to the system

- Utilize additional features to enhance investor relations

How to Choose the Right Distribution Method

Consider these factors when selecting a K-1 distribution approach:

- Investor preferences: Survey your investors to understand their comfort level with different methods.

- Security requirements: Evaluate the sensitivity of the information and required level of protection.

- Scale of your operation: Larger syndicates may benefit more from automated solutions.

- Budget: Weigh the costs of each method against the benefits and your available resources.

- Compliance needs: Ensure your chosen method meets any applicable regulatory requirements.

Best Practices for K-1 Distribution (Regardless of Method)

- Communicate clearly: Inform investors about when and how they’ll receive their K-1s.

- Be timely: Aim to distribute K-1s as early as possible within the tax season.

- Provide support: Offer a way for investors to ask questions or request assistance.

- Keep records: Maintain documentation of when and how K-1s were distributed.

- Stay consistent: Use the same distribution method for all investors when possible.

Legal and Compliance Considerations

While distributing K-1s isn’t typically subject to SEC registration, it’s important to handle the process with care:

- Protect personally identifiable information (PII) in accordance with privacy laws.

- Ensure any electronic distribution methods comply with IRS regulations for delivering tax forms.

- Consider having your distribution process reviewed by a legal professional specializing in securities law.

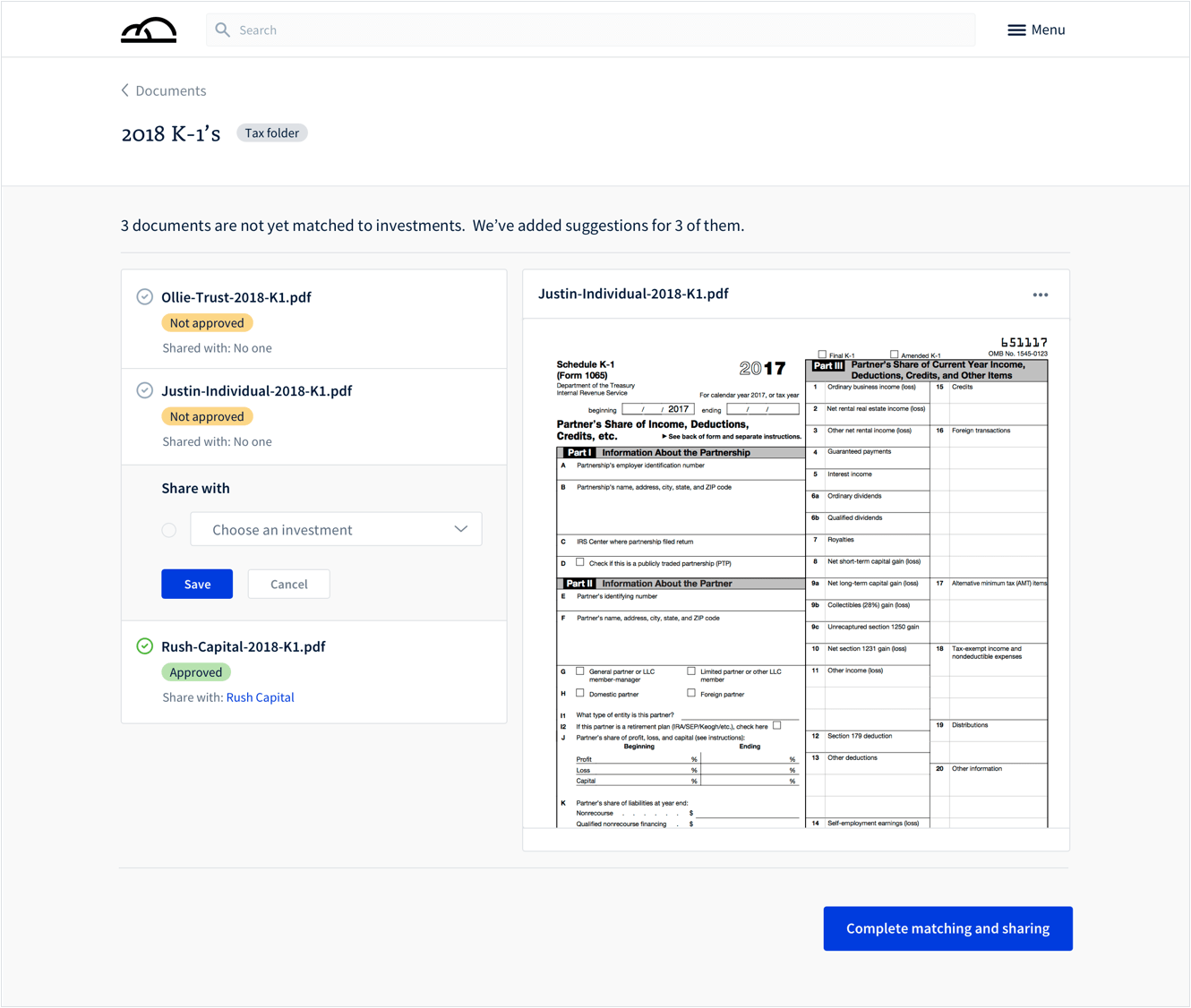

How Janover Connect Can Help with K-1 Distribution

Janover Connect offers a secure, streamlined solution for distributing K-1s and managing all aspects of investor relations:

- Automated distribution: Upload K-1s once and let the system handle delivery to the right investors.

- Bank-level security: Protect sensitive information with enterprise-grade encryption and access controls.

- Investor self-service: Allow investors to securely access their own documents at any time.

- Tracking and reporting: Easily monitor which investors have viewed or downloaded their K-1s.

- Integrated communication: Send notifications and reminders directly through the platform.

Our K-1 Sharing Tool is designed to automate the process of parsing and securely sharing K-1 tax statements in bulk. What once might have taken days becomes about 10 minutes of your team’s time.

Whether you’re managing a handful of investors or a large-scale syndication, Janover Connect can simplify your K-1 distribution process while enhancing security and investor satisfaction.

Ready to see how Janover Connect can transform your K-1 distribution and overall investor management? Schedule a free demo today to learn more.

Frequently Asked Questions

Can I legally send K-1s via email?

Yes, it is legal to send K-1s via email, but you must take appropriate security measures to protect sensitive information. This typically includes encryption and password protection.

How early should I start preparing for K-1 distribution?

Start planning at least 2-3 months before the distribution date. This gives you time to gather necessary information, prepare the forms, and set up your chosen distribution method.

What if an investor doesn’t receive their K-1?

Have a process in place for investors to request a new copy. Keep records of all distributions and be prepared to resend K-1s through a secure method if needed.

Do I need to get investor consent to distribute K-1s electronically?

While not always legally required, it’s a good practice to get investor consent for electronic distribution. This can be done when they first invest or through a separate opt-in process.

How long should I keep K-1s available to investors?

Provide access for at least 3-4 years, as investors may need historical K-1s for tax amendments or audits. Some platforms allow for indefinite secure storage, which can be a valuable feature for both you and your investors.

By following these best practices and choosing the right distribution method for your syndicate, you can ensure a smooth, secure K-1 distribution process that keeps your investors happy and your operation compliant.

Raise Capital Faster with Janover Connect

Elevate your real estate investment and syndication processes with Janover's comprehensive platform.

- Fundraising Automation

- Investor Portal

- Distribution Management

- Reporting & Analytics

Subscribe to Our Blog

Join 2,000+ syndicators in getting guides, models, presentation templates, and more resources created to help you become a better investor.

Empower Your Real Estate Investments

Janover Connect provides powerful tools to streamline your real estate investment and syndication processes.

Janover Connect

Streamline your real estate syndication, impress your investors and close deals on autopilot.

- Fundraising Automation

- Investor Portal

- Investor Reporting

- Distribution Automation

- K-1 Sharing

- Communication Tools

Janover Engage

Raise funds faster and easier by getting your syndication deals in front of the right investors.

- 52,549+ investors network

- $1B+ confirmed investments

Ready to Transform Your Investment Process?

Discover how Janover Connect can help you impress investors, close deals, and manage your real estate empire with ease.