The Guide to Delaware Statutory Trusts

by Janover Team

Last updated on October 15, 2024

In this article, we’ll explore the Delaware Statutory Trusts or DSTs pros and cons, a relatively lesser-known real estate investment structure that has enjoyed an uptick in prevalence with investors and operators preferring a flight-to-quality as the economic cycle has matured.

What is a Delaware Statutory Trust and why use it?

A DST is an ownership model through a separate legal entity that allows co-investment among real estate sponsors and accredited investors to purchase beneficial interest into either a single asset or across a portfolio of properties. The most notable characteristic of DSTs, which we’ll dive into later on, is that they are tax-deferred 1031 exchange-friendly.

You’ll walk away from the reading with a thorough understanding of what it is and what are the pros and cons of Delaware Statutory Trusts structure in real estate. Answering to the following two questions: What is a Delaware Statutory Trust? And, how is it best utilized in real estate?

History

While not new, Delaware Statutory Trusts have become increasingly popular as an alternative commercial real estate investment vehicle for sponsors and real estate investors alike thanks to some of its unique characteristics and uses.

The rise of DSTs can be primarily attributed to two events.

IRS Revenue Ruling 2004-86

The prominent changes to tax legislation occurring in 2004 introduced formal IRS guidance outlining their stance on these fractional-ownership exchanges and securitized replacement property programs.

The Great Recession

Prior to the 2007 credit crisis and resulting in the real estate market crash, most fractional-ownership models were organized under a Tenants-In-Common (TIC) structure. Major complications within this structure were exposed by the market crash and have since fallen out of favor - more on that later.

In conjunction, these two occurrences elevated DSTs to the forefront of both fractional-ownership and replacement property programs. At its peak in 2006, securitized tax-deferred exchanges accounted for a staggering $4 billion in transactional volume. As sales contracted along with the economy, Section 1031 exchange programs saw a devastating reduction in investment, bottoming out to approximately $100 million in 2009. While not yet back to peak levels, 2018 saw the continued growth of this market segment with sales increasing to $2.52 billion, compared to the $1.97 billion recorded in 2017. As tax law and market cycles evolve, DSTs have become the structure of choice amongst sponsors seeking exposure to the tax-deferred 1031 exchange market, with some firms quoting DSTs make up 90-96% of their securitized real estate investment offerings for 1031 exchange.

Structure & Fees

To better understand the attraction of DSTs, we’ll explain the structure that makes DSTs so popular amongst commercial real estate investors.

While sharing some similarities with single-entity or tenant-in-common (TIC) structures, a Delaware Statutory Trust offers structural simplicity from an investor standpoint. While co-ownership agreements, special purpose entities, and personal guarantees are typically mandated within most JV or TIC structures, DST investors only needs to execute a trust agreement, providing them with unencumbered pro-rata Class B beneficial interest in the stated Delaware Statutory Trust.

| Comparison Point | DST | TIC |

|---|---|---|

| Number of Investors | Unlimited, though typically capped at 499 | Up to 35 |

| Investor Ownership | Percentage of beneficial ownership in a Trust that owns the property | Undivided interest in the property |

| Number of Borrowers | 1 (the DST) | Up to 35 (each investor is a borrower) |

| Major Decisions | No investor voting rights | Equal voting rights and unanimous consent |

| Bankruptcy Remote | Provided by DST structure | Investors must form Single Member LLC |

| Investor Guarantees | Not needed | Investors generally required to provide “carve-outs” |

| IRS Guidance | Revenue Ruling 2004-86 | Revenue Procedure 2002-22 |

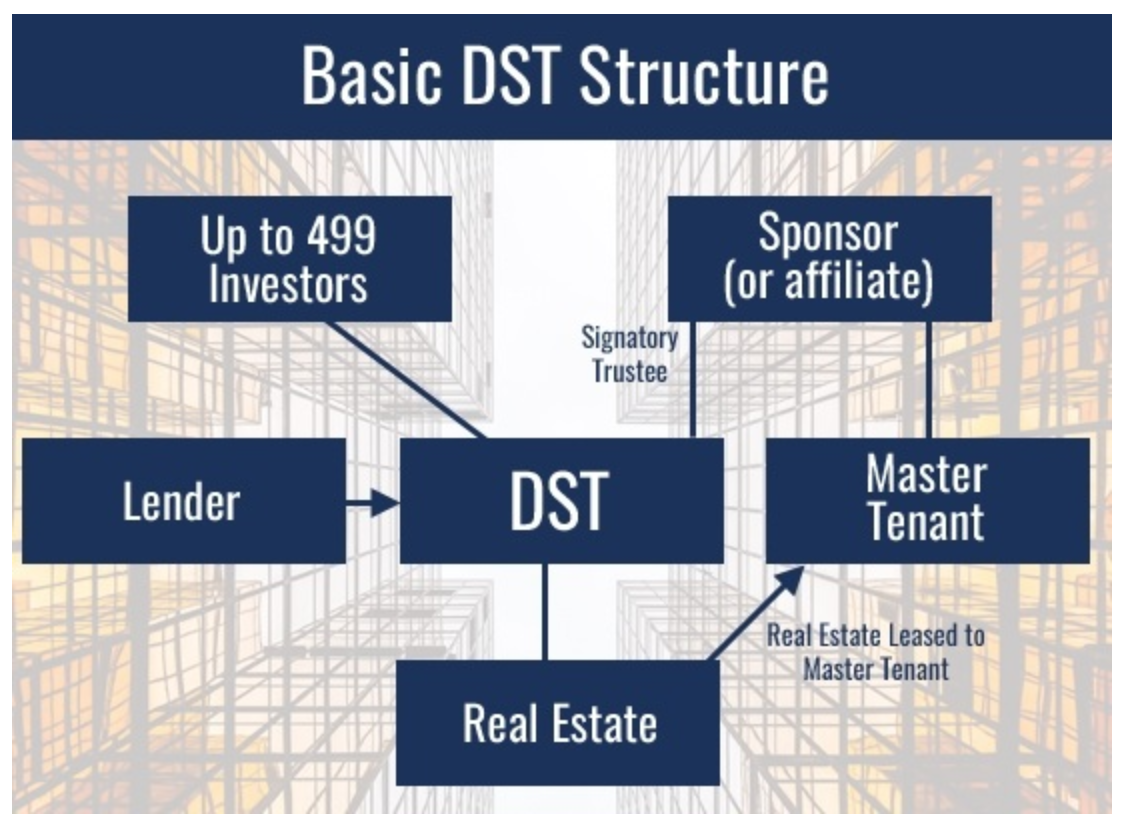

The Delaware Statutory Trusts entity itself becomes the sole holder of the title of the real property subject to investment. Outlined within the trust agreement, the sponsor can jointly act as the trustee, manager and master lessee. This agreement places them in full control of the day-to-day operations of the commercial real estate investment, subject to restrictions defined by the IRS, which will be highlighted below.

Basic Structure

The managing real estate sponsor may engage accredited investors directly or utilize securities brokers-dealers to help satisfy the outstanding equity requirements that remain after lender terms are negotiated. Similar to an LLC, investors are protected from liabilities incurred beyond their initial investment.

Due to tax laws, many of the promote or waterfall distribution models described in the article about Common Structures and Fees are not applicable here. Conversely, distributions derived from fractional-ownership are handled on a pro-rata basis. While the managing sponsor collects disposition, property, and asset management fees similarly to other structures, sponsors oftentimes seek higher acquisition fees (6-9%), a scenario we will touch on further below.

Investment Scenarios

Let’s look at some scenarios to highlight the most common ways DSTs are utilized and why, both from the perspective of the commercial real estate investor as well as the sponsor. In light of using the DST structure, we will explore the decisions that affect the length of an assets’ hold period, acquisition and disposition strategies, and two scenarios in which DSTs are most commonly deployed: the front-end and the back-end raise.

Front-End Raise

Functioning similarly to traditional GP/LP JV relationships, the equity raise in this scenario is done in conjunction with the acquisition. The Sponsor must fund their acquisition through the outside investment made into the already-formed DST. Title transfer occurs only after the full equity requirements are satisfied.

Back-End Raise

While the structure itself may or may not vary, timing is the differentiator in this scenario. When pursuing a back-end raise, the initial investment entity will have already funded and closed upon the asset prior to any formal investor offering. The asset will then be packaged with an operator, property management, completed due diligence, and potentially new debt in-place. This effectively functions as a recapitalization method for the initial investment entity. To reflect the risk taken on by the sponsor, these offerings will typically see a higher acquisition fee included. Whether or not intended, this scenario offers an alternative option for sponsors seeking to stay in a deal. The mechanisms behind this scenario allow for third-party operators to be brought in, broadening the ownership profile once associated with direct fractional-ownership.

Disposition Plan & Exit Strategies

As with any real estate investment, it is vital to understand the path to profit. While cash flows can be enjoyed throughout the hold period, appreciation on an asset can only be realized through the liquidation of interest, either through a refinancing or an outright sale. DSTs present some limitations to traditional ownership cycles, thanks in large part to IRS regulations. Because of these regulations, investors must understand the risks involved and select an experienced sponsor capable of navigating these potential hazards. Below, we will outline four common exit strategies employed by DSTs.

Arms-Length Disposition

At the end of the hold period, the sponsor may seek an open market sale of the property. Ideally, the pro forma is met or exceeded, and appreciation can be realized. With the successful disposition negotiated, each investor will receive their pro-rata share of proceeds upon sale.

Buyout

As an asset nears the end of its intended hold period, the sponsor may elect to buy the Class B beneficial interest owned by outside private investors. asset’s performance typically influences this decision. If the asset underperformed, the sponsor might seek to make their investors whole and pursue other value-added activities outside the structural confines of a DST. Conversely, perhaps the asset performs well and proves a valuable long-term hold for the sponsor. Regardless, investors would then have their interests liquidated, subject to further 1031 exchange, if so desired.

LLC-Conversion

Referred to as a “Springing LLC,” a Delaware Statutory Trust can be converted into an LLC under defined circumstances. Limitations to the DST structure typically preclude such conversion, at which point the new LLC entity would be treated as a partnership for tax purposes. It should be noted that an investors’ ability to qualify for future 1031 exchange’s may be affected if the decision to convert and initiate a “Springing LLC” is made.

REIT / UPREIT

The mechanisms in play to convert Delaware Statutory Trusts into a REIT can come about in two distinct ways - internally or externally. An internal conversion functions almost as a hybrid between a buyout and an LLC conversion. If the sponsor already operates or is capable of issuing a REIT or UPREIT within the confines of their firm, an investor will be given the option of converting their beneficial interest in the DST to an interest in the REIT or to liquidate their sale proceeds - potentially into another exchange. However, these options would strip investors of their direct real estate investment interest, and therefore, those additional tax benefits previously enjoyed. Additionally, future 1031 exchange qualification may be affected. An external conversion would operate as a hybrid between an arms-length disposition and the internal REIT conversion addressed above.

Advantages & Disadvantages of Delaware Statutory Trusts in Real Estate

As with any investment, the decision to deploy various investment strategies and structures may be advantageous or disadvantageous depending on the situation. Let’s explore how DSTs differentiate themselves and look at situations in which they may face challenges. Sponsors and investors alike must remain keen on how to best operate within the structural limitations, especially on how to avoid any red flags from the IRS.

Sponsor

From the real estate sponsor’s perspective, many of the advantages have already been touched on, but let’s look a little deeper. Why should DSTs be widely integrated into sponsors’ business models and offerings?

1. Access to the 1031 exchange Market

With tax law on its side, DSTs have allowed sponsors direct access to a multi-billion dollar market segment, which no prior structure has successfully allowed. Investors of all sizes and experience-levels widely use tax-deferment programs, an investor profile that has historically been left untapped by sponsors.

2. Secondary Market Recapitalization

Creative financial structures have long been leveraged as part of successful real estate deals and the way in which DSTs allow for flexibility in the capital stack is imperative to its popularity.

3. Retain Deal Control

A DSTs managing sponsor retains the final say over decisions. Other structures allow voting rights to be retained by Class B members or mandate unanimous member approval. This, as the case in TIC, can prove a major stumbling block as adverse situations arise and reaching member approval becomes an issue. “Rogue investors” present no threat to DSTs.

4. Equity Contribution Flexibility

Lower dollar contribution minimums, as well as higher individual investor limits, are two benefits enjoyed within a Delaware Statutory Trust. While the sponsor may set their own contribution minimums or investor limits, the IRS allows cash investments as low as $25,000 with no limit on the number of participants, although contributing investors are typically capped at 499.

5. Traditional Deal Fees

While sponsors are not allowed to collect preferred returns under IRS stipulations, typical fees such as property and asset management along with associated deal costs, such as acquisition and disposition fees, are regularly sought by sponsors.

While many of the pitfalls observed in other structures are absent with a DST, the IRS has outlined specific restrictions (“disadvantages”) intended to limit the use and scope made available to Delaware Statutory Trusts. These seven restrictions have been dubbed the “7 Deadly Sins”

1. Future Capital Contributuons

Once the offering is closed, there can be no future capital contributions to the DST by either current or new beneficiaries.

Sponsors combat this issue by baking in heavy reserves on the front-end raise to ensure that a lack of future capital calls does not place undue risk on the investment. Additionally, the last-grasp option of LLC conversion can offer a safety net.

2. Debt Restrictions

The trustee cannot renegotiate the terms of existing loans and cannot borrow new funds from any party unless a loan default exists as a result of a tenant bankruptcy or insolvency.

For this reason, the typical hold period of a DST is 5-7 years. The vast majority of deals will exit prior to loan maturity.

3. Lease Restrictions

The trustee cannot enter into new leases or renegotiate current leases unless there is a need due to a tenant bankruptcy or insolvency.

Net-leased assets are preferred by some in a DST structure to avoid the need to renegotiate. Alternatively, apartments, office buildings, retail centers, and other multi-tenant assets require a master lease structure to circumvent this restriction.

4. Reinvestment of Proceeds Restrictions

The trustee cannot reinvest the proceeds from the sale of its real estate.

The choice is retained by each investor to decide how to handle individual sale proceeds.

5. Limitation of Capital Expenditures

Capital expenditures concerning the property are limited to normal repair and maintenance, nonstructural capital improvements, and those required by law.

Reserves, when underwritten correctly, can handle capital repairs. These reserves are often mandated by the lender. Alternatively, a back-end raise can allow for major capital improvements to be addressed prior to DST ownership transfer. It is important to note, a DST is not an appropriate structure to utilize when seeking a redevelopment.

6. Restrictions on Investing Reserves

Any reserves or cash held between distribution dates can only be invested in short-term debt obligations.

This is to ensure the safety and readiness of the investors’ capital.

7. Distribution Requirements on Cash

All cash, other than necessary reserves, must be distributed on a current basis.

A true pro-rata share is required, and regular cash flows must abide as well.

Investor

Now let’s review the reasons Delaware Statutory Trusts are attractive to the individual real estate investor.

1. 1031 exchange-Friendly

As previously mentioned, the single most notable trait of DSTs is its status as a qualified replacement property program. This means that…

2. Passive Income

With major decisions left up to the Managing Sponsor, DSTs offer investors management-free investments - true mailbox money. Because decision making is outlined within the trust agreement, DSTs offer a more centralized, nimble, and decisive ownership structure that effectively mitigates any “rogue investor” risk factor.

3. Real Property Interest

Opposite to REITS, land-leases, and other passive ownership structures, DSTs pass tax benefits of real property interest down to individual investors. Owners receive their proportionate share of all income, tax deductions, and appreciation.

4. Access to Institutional-Quality Assets & Management

DSTs allow individual investors to invest in large, institutional-quality investment properties with professional management otherwise outside of their scope. Additionally, DSTs can be used to invest across an entire portfolio of assets. This type of diversification within direct investments is otherwise difficult and expensive to achieve.

5. Limited Personal Liability

Lenders view the Trust as the sole borrower. There is zero need for the lender to approve individual investors and therefore, no need for personal guarantees or “bad boy carve outs.” This effectively makes the financing process nearly nonexistent for individual investors. This reduces financing costs while allowing for more attractive, non-recourse options.

We set out to answer the following two questions: What is a Delaware Statutory Trust? And, how to form a Delaware Statutory Trust?

Thanks to a comprehensive review of how real estate sponsors, investors, and the IRS view DSTs, you should confidently understand the important role they serve in today’s market and appreciate the niche segment DSTs have evolved to serve. DSTs check a lot of boxes for all participating parties and have proven to be one of the most adaptable solutions present in the market today. It is no surprise DSTs appear primed to continue their dominant share of securitized real estate and replacement property program.

Join 6,000+ syndicators in getting guides, models, presentation templates, and more resources created to help you become a better investor.

Raise Capital Faster with Janover Connect

Elevate your real estate investment and syndication processes with Janover's comprehensive platform.

- Fundraising Automation

- Investor Portal

- Distribution Management

- Reporting & Analytics

Subscribe to Our Blog

Join 2,000+ syndicators in getting guides, models, presentation templates, and more resources created to help you become a better investor.

Empower Your Real Estate Investments

Janover Connect provides powerful tools to streamline your real estate investment and syndication processes.

Janover Connect

Streamline your real estate syndication, impress your investors and close deals on autopilot.

- Fundraising Automation

- Investor Portal

- Investor Reporting

- Distribution Automation

- K-1 Sharing

- Communication Tools

Janover Engage

Raise funds faster and easier by getting your syndication deals in front of the right investors.

- 52,549+ investors network

- $1B+ confirmed investments

Ready to Transform Your Investment Process?

Discover how Janover Connect can help you impress investors, close deals, and manage your real estate empire with ease.