K-1 Sharing

Automate parsing and secure sharing of K-1 tax statements with investors.

Sharing K-1s securely doesn't need to take days. With Janover Connect you can automate parsing K-1s to investors and be done in minutes.

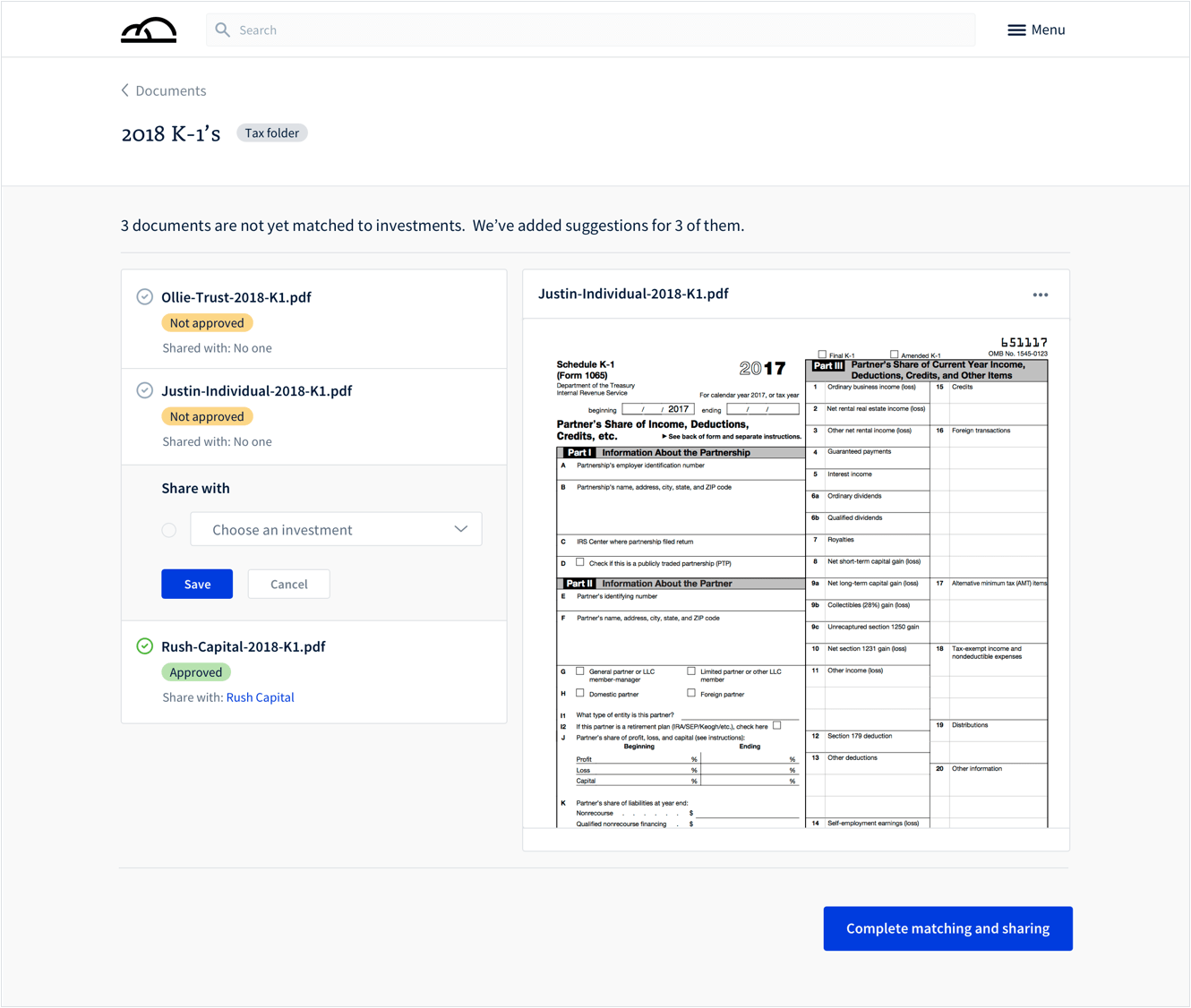

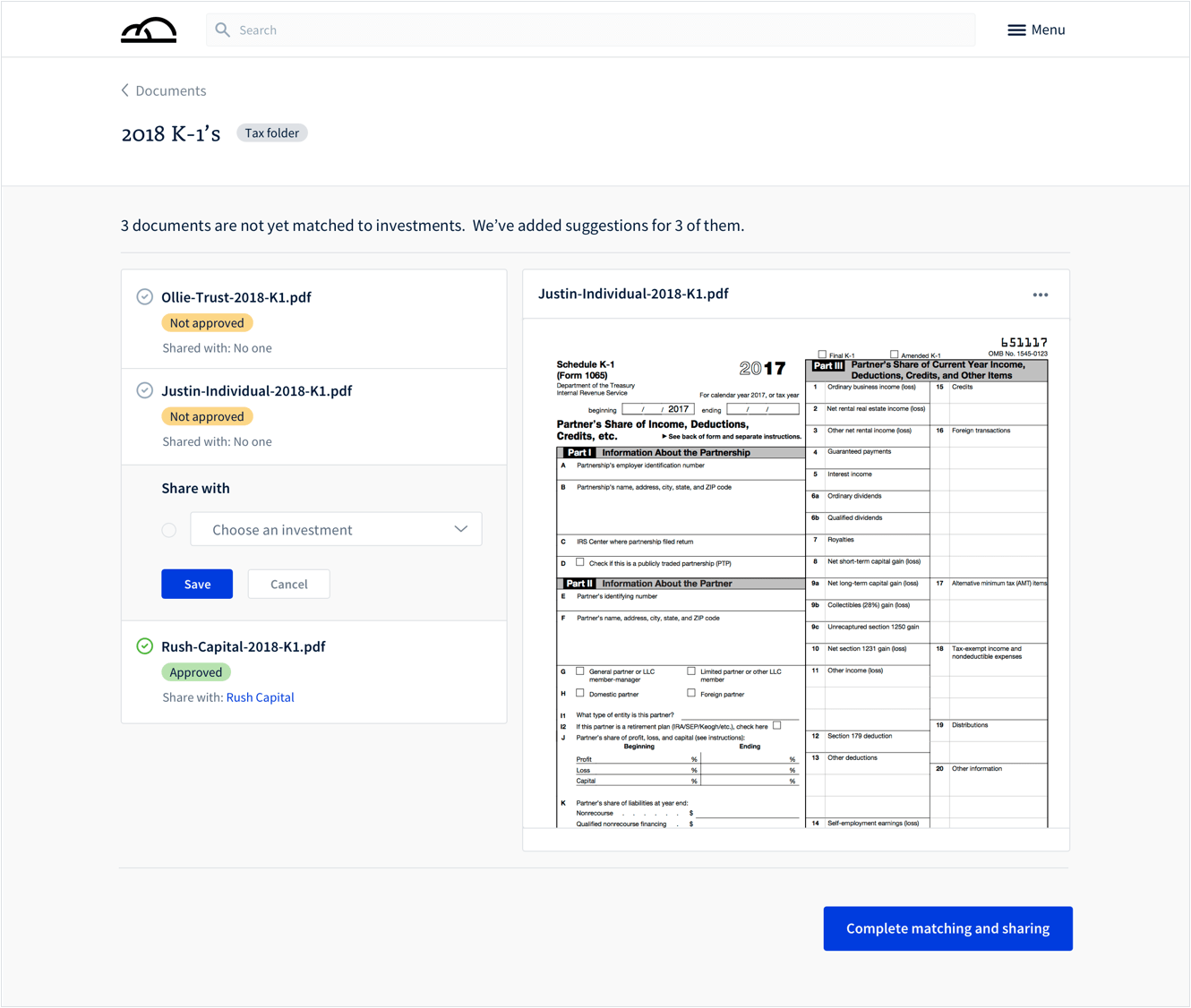

K-1 Sharing Tool

Give your internally or externally facing accounting team back office software to parse and securely share K-1 tax statements in bulk with your real estate investors in a fraction of the time it typically takes them.

Simply drag and drop or upload documents, then, automatically match to the appropriate investment entities. To ensure accuracy, approve or adjust each match before sending. What once might have taken days becomes 10 minutes of your team's time.

- Automatically parse and securely share K-1 tax statements with investors

- Set personalized notifications to inform investors that their K-1s are ready

- Save time, cut costs, and give investors and delegates one software portal to download documents

Why you'll love this tool:

Distributing K-1 tax statements can be a pain because year in and year out there's really no good way to handle it securely and efficiently. Mail is labor intensive and may not reach the best address. Email is not secure — you should redact sensitive data, and the file can live forever in an inbox that may eventually be hacked.

With Janover Connect real estate investment management software in your arsenal, once accounting does their audit, our tool to parse and securely share K-1 tax statements gets these documents out the door quickly and removes you from the bottleneck. Investors can get a more accurate time frame to receive their K-1 tax statements and you can reduce or eliminate requests.

Also in Janover Connect

- ⤷ Distribution Automation

Automatically calculate and post distributions, notify investors, and transfer ACH funds in minutes. - ⤷ Customer Relationship Management

Manage investor relationships effortlessly with our purpose-built CRM for real estate syndicators. Streamline communications and boost productivity. - ⤷ Investor Portal

Provide a better investor experience with convenient self-service and transparent report access.